Arabian Internet and Communication Services Company (TADAWUL:7202) First-Quarter Results Just Came Out: Here’s What Analysts Are Forecasting For This Year

Traders in Arabian World-wide-web and Conversation Expert services Company (TADAWUL:7202) had a very good 7 days, as its shares rose 3.1% to close at ر.س296 adhering to the release of its 1st-quarter results. Success general ended up respectable, with statutory earnings of ر.س2.53 for each share roughly in line with what the analysts experienced forecast. Revenues of ر.س2.7b arrived in 4.% forward of analyst predictions. Earnings are an critical time for buyers, as they can keep track of a firm’s functionality, seem at what the analysts are forecasting for next yr, and see if you can find been a improve in sentiment toward the firm. We’ve gathered the most latest statutory forecasts to see no matter whether the analysts have adjusted their earnings types, pursuing these effects.

See our hottest assessment for Arabian Internet and Communication Solutions

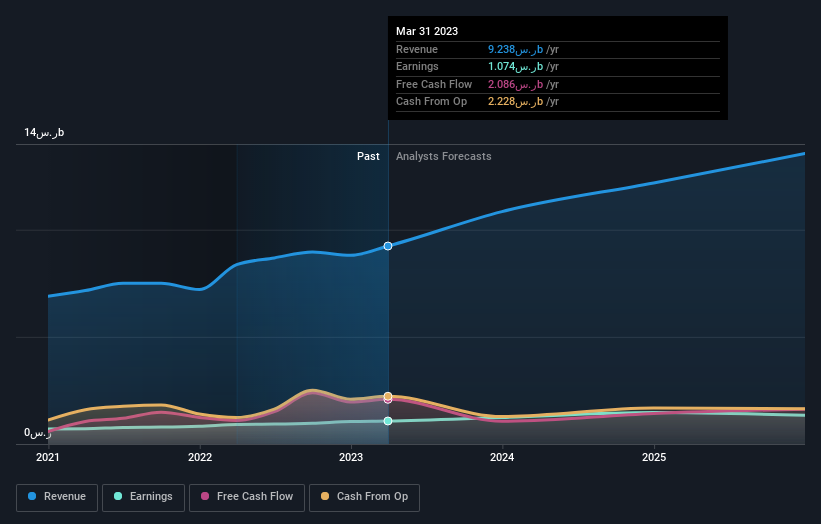

Taking into account the most recent final results, the current consensus from Arabian World-wide-web and Communication Services’ eight analysts is for revenues of ر.س11.0b in 2023, which would mirror a significant 19% increase on its sales more than the past 12 months. Statutory earnings for every share are predicted to increase 9.5% to ر.س9.88. But prior to the most up-to-date earnings, the analysts experienced been expected revenues of ر.س10.8b and earnings per share (EPS) of ر.س9.88 in 2023. So it is really really very clear that, while the analysts have up to date their estimates, there is been no key modify in expectations for the company adhering to the hottest effects.

The analysts reconfirmed their value target of ر.س294, showing that the organization is executing very well and in line with expectations. There’s yet another way to imagine about value targets nevertheless, and that is to look at the vary of price targets put forward by analysts, since a wide variety of estimates could propose a assorted perspective on possible outcomes for the business. The most optimistic Arabian Online and Conversation Providers analyst has a value target of ر.س311 per share, when the most pessimistic values it at ر.س280. With this kind of a slender selection of valuations, the analysts evidently share identical views on what they feel the small business is truly worth.

A further way we can look at these estimates is in the context of the greater photograph, such as how the forecasts stack up in opposition to past functionality, and whether forecasts are additional or fewer bullish relative to other organizations in the field. The analysts are absolutely expecting Arabian Online and Conversation Services’ growth to speed up, with the forecast 26% annualised progress to the close of 2023 rating favourably alongside historical growth of 10% per annum over the earlier calendar year. Evaluate this with other corporations in the exact same sector, which are forecast to grow their revenue 9.3% yearly. Factoring in the forecast acceleration in income, it truly is really clear that Arabian Web and Interaction Products and services is expected to expand significantly more rapidly than its business.

The Bottom Line

The most noticeable summary is that there’s been no big transform in the business’ prospects in new occasions, with the analysts holding their earnings forecasts constant, in line with former estimates. Fortunately, there ended up no major variations to profits forecasts, with the company however expected to improve quicker than the wider marketplace. There was no genuine transform to the consensus selling price goal, suggesting that the intrinsic benefit of the small business has not gone through any main adjustments with the latest estimates.

Pursuing on from that line of believed, we assume that the prolonged-time period potential customers of the enterprise are significantly a lot more applicable than next year’s earnings. We have forecasts for Arabian World-wide-web and Interaction Solutions likely out to 2025, and you can see them no cost on our platform listed here.

We also deliver an overview of the Arabian Net and Communication Services Board and CEO remuneration and length of tenure at the corporation, and irrespective of whether insiders have been obtaining the stock, below.

Valuation is complex, but we’re aiding make it easy.

Uncover out no matter whether Arabian World wide web and Communication Products and services is probably in excess of or undervalued by checking out our complete evaluation, which involves good worth estimates, risks and warnings, dividends, insider transactions and financial health.

Watch the No cost Evaluation

Have opinions on this report? Involved about the information? Get in touch with us right. Alternatively, e mail editorial-workforce (at) simplywallst.com.

This posting by Merely Wall St is typical in nature. We present commentary based mostly on historic info and analyst forecasts only making use of an unbiased methodology and our article content are not supposed to be money advice. It does not constitute a suggestion to invest in or offer any inventory, and does not acquire account of your goals, or your economic predicament. We purpose to bring you extensive-expression centered assessment pushed by essential knowledge. Observe that our assessment may possibly not component in the hottest cost-sensitive enterprise announcements or qualitative content. Just Wall St has no situation in any shares stated.